We’re thrilled to unveil the latest addition to Patterns ID: the Sectors page! This new feature is designed to provide users with an in-depth comparison of Conditional Statistics™ across sectors of the S&P 500 and the index itself. As we continue to enhance our platform, the Sectors page marks another step in identifying market patterns for retail traders.

Conditional Statistics™ Across Sectors

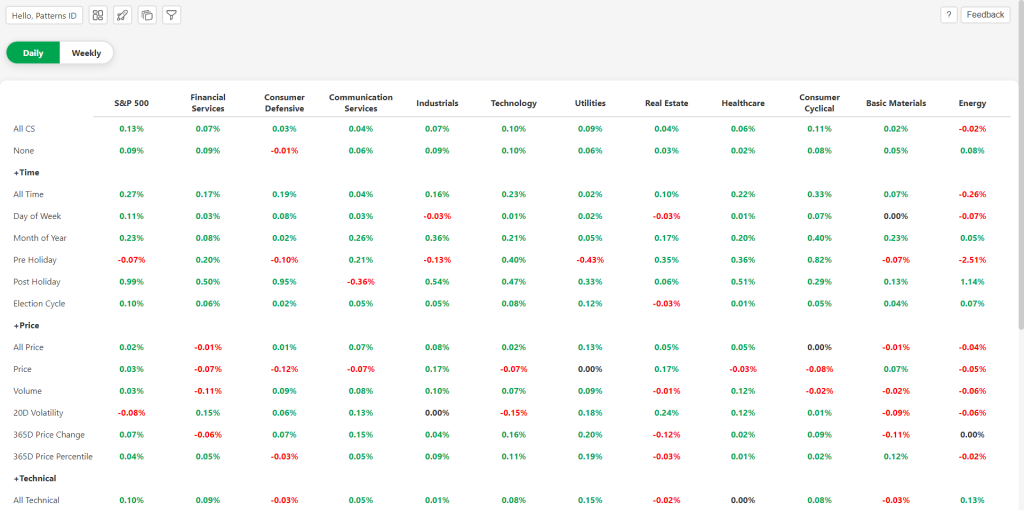

The Sectors page allows you to explore Conditional Statistics™ for different sectors of the S&P 500. This feature provides a unique opportunity to compare the historical returns of each sector against the overall index under various conditions. Whether you’re a seasoned trader or just getting started, this tool will help you gain valuable insights into market trends and sector performance. The Conditional Statistics™ are grouped by type (time, price, technical and fundamental) and have cumulative rows that identify which sectors have historically performed strong and weak under the current conditions.

Daily and Weekly Averages

To provide even more flexibility and depth in your analysis, the Sectors page offers both daily and weekly Conditional Statistics™. This allows you to toggle between different timeframes and gain a more comprehensive understanding of sector performance over various periods. Weekly stats are updated at the end of each week and can provide further tailwind to insights found under daily stats through the following week.

Future Enhancements: Sector Price Charts

We’re committed to continuous improvement and adding value to your experience on Patterns ID. In the near future, we will be introducing sector price charts to the Sectors page. These charts will graph price movements within each sector in addition to the Conditional Statistics™. Stay tuned for these exciting updates!

What’s Next?

Following the launch of the Sectors page, we’re already hard at work on the next series of updates. Up next is a comprehensive enhancement of the Dashboard page. These upgrades will bring new features and improved functionalities, making it easier for you to track and analyze individual stocks.

Thank you for being a part of the Patterns ID community. We look forward to bringing you more exciting updates soon!